- Home

- Sustainability

- Corporate Governance

- Business Management and Execution Structure

Business Management and Execution Structure

Corporate Governance System

Following the partial amendment of the Articles of Incorporation, which was approved at the 70th Ordinary General Meeting of Shareholders held on June 28, 2022, J-POWER transitioned to a company with an Audit & Supervisory Committee effective as of the same date. Following the transition, we have established a system of mutual oversight among Directors through the attendance at meetings of the Board of Directors of Outside Directors who participate in the Company's management decision-making from an independent position.

The Board of Directors delegates the execution of important business to Directors to enable speedy execution. At the same time, the Company is further improving the transparency and fairness of its management and strengthening its supervisory function by increasing the number of Outside Directors with voting rights on the Board of Directors and through the Audit & Supervisory Committee's right to express opinions on Director nominations and compensation. In fiscal 2019, the Company established a Nomination and Compensation Committee, more than half the members of which are Independent Officers, to enhance the independence, objectivity and accountability of the Board of Directors with regard to the nomination and compensation of Directors and top management.

Furthermore, the execution of duties by Directors is constantly monitored through their comments at meetings of the Board of Directors and other management meetings by the Audit & Supervisory Committee, which includes outside Audit & Supervisory Committee Members with abundant experience in such areas as the management of leading Japanese companies and the execution of government policies. The Company believes this system allows for sufficient corporate governance functionality.

In addition to the above, the Company has also established an Executive Committee.

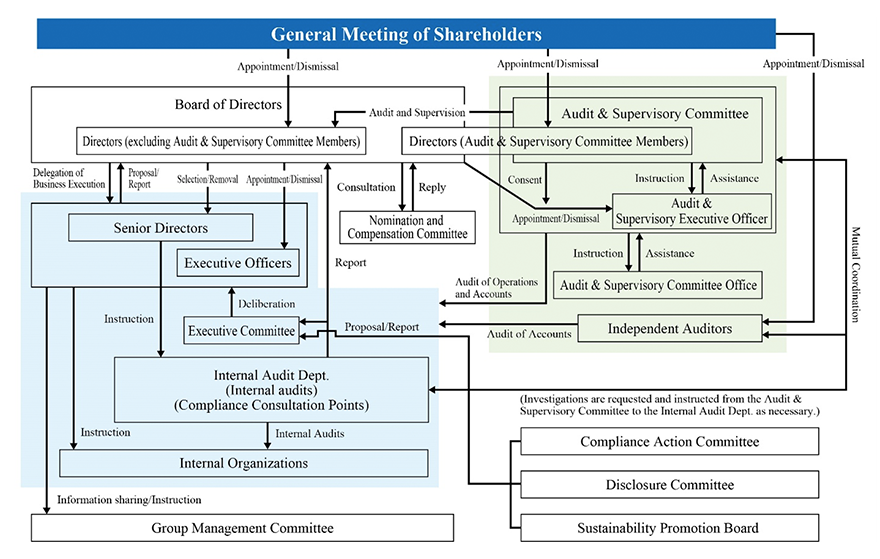

Corporate Governance Structure and Internal Control System Chart

(as of 28 June 2022)

1. Composition of the Board of Directors and the Audit & Supervisory Committee

Composition of the Board of Directors

The Board of Directors is composed of Directors with abundant experience, deep insight and highly specialized knowledge to maintain balance and diversity in the knowledge, experience, and abilities of the Board of Directors as a whole. The Company appoints up to 16 internal and external Directors in total, including 12 Directors (excluding Directors those who are members of the Audit & Supervisory Committee) and four Directors who are members of the Audit & Supervisory Committee ("Audit and Supervisory Committee Members").

To ensure the effectiveness of the independent and objective management supervision by the Board of Directors, the Company endeavors to appoint at least one-third of Independent Outside Directors selected for their experience, knowledge, specialization, and other attributes.

Currently, the total number of Directors is 16, including six Independent Outside Directors.

Composition of the Audit & Supervisory Committee

The Audit & Supervisory Committee is composed of a maximum of four Audit & Supervisory Committee Members, the majority of whom are Outside Audit & Supervisory Committee Members. At least one person with appropriate knowledge of finance and accounting is appointed as an Audit & Supervisory Committee Member.*

Currently, the total number of the Audit & Supervisory Committee Members is four, including three Independent Outside Audit & Supervisory Committee Members.

- *Audit & Supervisory Committee Member, Hiroshi Fujioka (full-time, Independent Outside Audit & Supervisory Committee Member), has significant knowledge of finance and accounting through his many years of experience in public administration practices such as public finance and financial issues, etc.

2. System for the Execution of Directors' Duties

Ensuring Effectiveness in the Execution of Duties

The Board of Directors meets monthly in principle and on an as-needed basis, with attendance of all of the Directors, including the Outside Directors. The Executive Committee meets weekly in principle, with the attendance of all Senior Directors*1, Titled Executive Officers, full-time Audit & Supervisory Committee Members and Specially Appointed Audit & Supervisory Committee Member, to discuss matters to be referred to the Board of Directors and important company-wide matters and important matters pertaining to individual business execution related to business executed by the President and Executive Vice Presidents based on policies decided by the Board of Directors.

The Board of Directors delegates some decisions on important business execution (excluding the matters stipulated in each item of Article 399-13, Paragraph 5 of the Companies Act) to Senior Directors in accordance with the Articles of Incorporation, and allocates functions to the Board of Directors and Executive Committee. In addition, by establishing a system in which Executive Officers, to whom authority is delegated by Senior Directors, share responsibility for business execution, the Company clarifies responsibility and authority thereby ensuring accurate and prompt decision-making and efficient corporate management.

Notes:

- 1: Senior Directors: Chairman, President

Ensuring Appropriateness in the Execution of Duties

The Company has established an Internal Audit Department to ensure proper business execution and conducts internal audits from a position independent from the other operating units. Each operating unit also conducts periodic self-audits of the execution of business in its unit. In addition, important internal audit results are reported to the Board of Directors, the Audit & Supervisory Committee, and the Executive Committee, etc., to ensure cooperation between the Internal Audit Department, Directors (excluding Director who are Audit & Supervisory Committee Members), and the Audit & Supervisory Committee.

Preventing Conflicts of Interest

Directors take the initiative to act with integrity and fairness based on a firm spirit of legal compliance and sense of ethics in accordance with our Corporate Philosophy, Corporate Conduct Rules, and Compliance Action Guidelines. In the event that the Company engages in transactions with Directors, etc.,* the Company works to prevent conflicts of interest by requiring advance approval of the Board of Directors for such transactions and the reporting of the results of the transactions to the Board of Directors.

- * Directors and major shareholders (shareholders with shares representing 10% or more of the voting rights in the Company)

3. Audits by Audit & Supervisory Committee

In accordance with the Companies Act, J-POWER appoints Audit & Supervisory Committee who audit the legality and appropriateness of the execution of business by Directors. The Audit & Supervisory Committee conduct audits at J-POWER's Headquarters by hearing statements made at meetings of the Board of Directors and by interviewing the Directors (excluding Directors those who are members of the Audit & Supervisory Committee) and Executive Officers on the status of the execution of Directors' and Executive Officers' duties. In addition, the Audit & Supervisory Committee perform site visits to local operating units and subsidiaries in Japan and overseas.

During the accounting audits, Audit & Supervisory Committee liaise with the Independent Auditors to regularly receive reports and exchange opinions regarding auditing schedules and the audit results. This enables Audit & Supervisory Committee to judge the validity of the auditing method of the Independent Auditors and the results of the audits.

To auditing staff under the Audit & Supervisory Committee, the Company has established an Office of Audit & Supervisory Committee as an independent unit separated from the Directors' chain of command. The office's Specially Appointed Audit & Supervisory Committee Member and full-time specialist staff assist the Audit & Supervisory Committee in the course of their audits.

4. Group Governance

With regard to the administration of subsidiaries and affiliates, the J-POWER Group's basic policy aims at integral Group-wide development in accordance with the Group's management plan. The administration of subsidiaries and affiliates is conducted in accordance with the Company's internal regulations, and the Group Management Committee works to improve the appropriateness of operations for the entire corporate Group. In addition, the Audit & Supervisory Committee and the Internal Audit Department conduct audits of subsidiaries and affiliates to ensure proper operations within the corporate group.

5. Evaluation of the Effectiveness of the Board of Directors

Since fiscal year 2015, the Company has been analyzing and evaluating the effectiveness of the Board of Directors and we disclose a summary of the results of the evaluation on an annual basis.

To improve the effectiveness of the Board of Directors, the Company strives to enhance the quality of discussions at monthly meetings of the Board of Directors and has implemented a number of initiatives, including the following.

- Enhancement of discussions on management strategy

- Ensuring speedy execution

- Use of the Nomination and Compensation Committee

- Initiatives to contribute to substantive improvements including the provision of information outside of meetings of the Board of Directors , inspections of power plants and other facilities by outside officers, and training for internal officers

6. Outside Officers

The Company's Outside Directors and Outside Audit & Supervisory Committee Members are independent officers who have fulfilled both the requirements for independent officers prescribed by the Tokyo Stock Exchange and the Criteria to Determine the Independence of Outside Officers* prescribed by the Company.

7. Appointment and Dismissal of Officers

When appointing members of the management executive and nominating candidates for Director or Audit & Supervisory Committee Member, the Board of Directors appoints or nominates persons with abundant experience, deep insight and advanced specialized knowledge who are deemed appropriate for selection as a management executive, Director, or Audit & Supervisory Committee Member after deliberations undertaken based on the recommendations of the President. After deliberation by the Nomination and Compensation Committee, the President nominates management executives and Director candidates.

In the event that there have been illegal or unjust acts by management executives or Directors, or if other circumstances arise in which it is deemed that there are serious impediments to the continuation of the performance of his/her duties, the Board of Directors will decide whether to dismiss or otherwise punish such management executives or Directors after deliberation by the Nomination and Compensation Committee.

8. Remuneration of Management

The Company's basic policy on remuneration for Directors (excluding Directors who are Audit & Supervisory Committee Members) and Executive Officers is to increase the linkage between remuneration and business performance as well as corporate value, and to provide an incentive for sustained improvement in business performance and increase in corporate value over the long term. To this end, the Company provides such officers with monthly cash-based remuneration, performance-linked remuneration, and stock-based remuneration. Remuneration for Outside Directors (excluding Directors who are Audit & Supervisory Committee Members) and Specially Appointed Audit & Supervisory Committee Member is limited to monthly remuneration in order to ensure their independence from business execution.