- Home

- Investor Relations

- Management Policy

- Top Message

Top Message

Message

Changes in the Business Environment

Two Years as President: A Changing Global Landscape

Two years have passed since I was appointed president, and during that time the environment surrounding the J-POWER Group has continued to grow more volatile.

In the United States, in addition to the significant shift in climate change policy following the inauguration of the Trump administration, the rapid introduction of AI and data centers (DCs) is bringing new waves of change to energy supply and demand. Meanwhile, the effect of the escalating situation in the Middle East on resource prices cannot be ignored, making it even more difficult to predict future trends for crude oil and other indicators. Forecasting resource prices has never been easy, but in recent years I believe that structural changes have also emerged that are influencing price dynamics.

For example, during the 1979 oil crisis, crude oil prices rose by approximately 2.7 times over a period of around three years. By contrast, despite the current tensions in the Middle East, we have not seen price movements of that scale to date. This indicates that there must be underlying changes not immediately visible. One major factor is the diversification of energy procurement networks. Since Russia’s invasion of Ukraine, Europe and Japan have curbed imports from Russia, and diversification of fuel procurement sources has advanced worldwide. Taking this trend into account, it can be inferred that reduced dependence on specific regions has contributed to greater price stability. That said, modern global civilization is such that even a single misstep can cause serious disruption. To steer effectively through this complex environment, we must also remain attentive to latent factors.

So how should the J-POWER Group chart its course? What I place particular importance on are the different “time horizons.” Some challenges must be addressed steadily from a long-term perspective, unaffected by changes in the external environment, while others require us to respond swiftly to shifts in the times. Over the past two years, I have come to recognize the importance of making sound decisions while remaining mindful of these different time horizons.

The Seventh Strategic Energy Plan and J-POWER’s Responsibilities

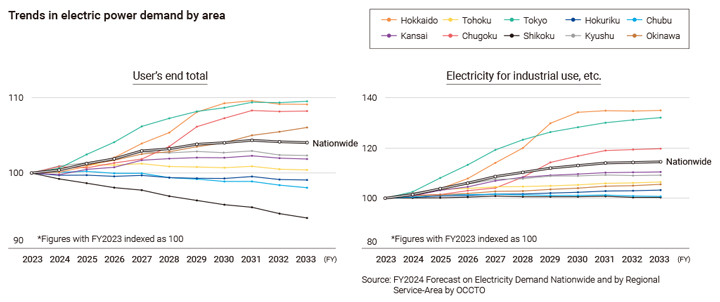

From a long-term perspective, Japan’s Seventh Strategic Energy Plan was approved by the Cabinet in February 2025. The plan maintains the principles of achieving carbon neutrality by 2050 and realizing “S+3E” (safety, energy security, economic efficiency, and environment) simultaneously, while placing greater emphasis on advancing decarbonization as a means of sustaining and enhancing Japan’s industrial competitiveness.

Japan once commanded the largest share of the global market for solar panels, but today domestic production has been significantly reduced under pressure from China. Likewise, when constructing new wind power plants, Japan is unable to procure key equipment domestically and must rely on imports. At the same time, domestic power demand is certain to grow with the expansion of the AI market and the increase in DCs and semiconductor plants. To regain lost industrial competitiveness, it is critically important to ensure a stable energy supply as the foundation of every industry, while also making steady progress toward carbon neutrality.

Advancing decarbonization while strengthening industrial competitiveness means that the J-POWER Group, which has defined its mission as “balancing a stable energy supply with response to climate change,” has an extremely important role to play. We intend to continue pursuing initiatives that advance both of these priorities in tandem.

One immediate challenge we must confront is the rising cost of carbon-neutral power sources. Wind and solar power, which depend on imported equipment and facilities, are directly affected by transport costs and inflation. Nuclear power also requires further investment to ensure safety. In addition, in Japan, renewable energy production sites are often far from the areas where the electricity is consumed, making investment in transmission and transformation networks that connect these regions essential. These are all prerequisites for achieving carbon neutrality, but ultimately the costs are passed on to consumers in the form of higher electricity rates. For the J-POWER Group, the priority is to supply society with the electricity it needs at low cost and with high stability, while working over the long term to curb the costs associated with carbon neutrality. At the same time, we must fulfill our responsibility to explain these issues clearly to our customers. Guided by this perspective, we will set priorities carefully and continue to approach our work as an energy company with both a sense of responsibility and enthusiasm.

Medium-Term Management Plan Progress

In 2024, we launched a new Medium-Term Management Plan. The previous plan was positioned as the first step toward our long-term direction, J-POWER “BLUE MISSION 2050.” Building on that foundation, the next step—Medium-Term Management Plan 2024–2026—sets forth the theme of transitioning our business portfolio and business model, and we are now moving forward with new initiatives.

Transitioning Our Business Portfolio and Business Model

In Japan today, the typical business model for power generation is to make large up-front investments in facilities and then operate them stably over the long term to secure returns. In contrast, in countries such as the United States and Australia, the buying and selling of power generation interests is much more active. Reflecting this business environment, we decided to sell our interests in the Green Country Power Plant (gas-fired) and other facilities in the United States.* In the course of transferring these interests, we successfully concluded the contracts under favorable conditions that ensured economic viability. Part of the proceeds will be reinvested in the development of large-scale solar power plants in the United States, enabling us to advance the transition of our overseas business portfolio. We expect this type of trading in power generation interests to become more common in Japan going forward. To enhance capital efficiency, we intend to incorporate a business model that captures developer profits through the sale of interests after developing power generation assets, thereby working to optimize our business portfolio.

- * From FY2024 onward, we have been proceeding with the sale of the Green Country Power Plant and other gas-fired power generation interests in North America.

In our renewable energy business, we are working to maximize environmental value through corporate PPAs with a range of operating companies. In FY2024, we signed 20-year contracts in the form of virtual PPAs with Tokyo Metro and KDDI covering non-fossil value and its associated prices. We plan to expand our customer base further, but at present each company has its own view of environmental value, and no consensus has yet been reached on price levels. At the same time, as Japan moves toward realizing a carbon-neutral society, we expect domestic customers to accelerate their efforts to secure CO₂-free power sources. There is also growing recognition of the high costs and hurdles involved in advancing renewable energy development in Japan. For the J-POWER Group, which already owns and operates large-scale CO₂-free power sources domestically over the long term and is continuing to expand them further, this trend represents a major business opportunity.

In expanding our CO₂-free power sources, the operation of the Ohma Nuclear Power Plant will also be essential. At present, a conformity review is under way by the Nuclear Regulation Authority based on new safety standards established in the wake of the Fukushima Daiichi accident. The review is making steady progress, with the standard tsunami height finalized in November 2024 and the standard seismic motion finalized in May 2025. With regard to the project’s revenue scheme, we are considering making use of the Long-Term Decarbonized Power Source Auction system to ensure investment recovery and steadily generate profits. We are advancing efforts with safety as our highest priority to make the Ohma Nuclear Power Plant a powerful performing asset for the J-POWER Group.

To achieve carbon neutrality, we must also decarbonize thermal power—in other words, “push for zero-emission power sources.” Transitioning to zero-emission thermal power, which emits no CO₂ during combustion, will require the introduction of hydrogen and ammonia. A challenge here is the high cost and energy required to transport these fuels from their production sites to the power plants. Considering these issues comprehensively, we believe that, at this stage, a better approach may be to transport fossil fuels to the plant and generate hydrogen onsite for power generation. Our ongoing GENESIS Matsushima Plan involves adding gasification facilities to existing equipment to enable the generation of hydrogen-rich gas and the use of hydrogen for power generation. This marks our first step toward CO₂-free hydrogen power generation and aims to position the project as a forerunner in zero-emission thermal power. In addition, we are moving forward with preparations for the commercialization of CCS, which will enable the storage of CO₂.

We are also focusing on building new business domains. In fields where our expertise can be applied, we believe new businesses can be created through investments in startups and collaboration with a wide range of partners. In July 2025, we signed a memorandum of understanding with Hitachi to cooperate in developing DCs for AI. As expectations for AI grow in Japan, we aim to leverage the CO₂-free power sources owned by the J-POWER Group to explore new growth opportunities. In addition, we are advancing a variety of projects, including biomass fuel production and battery utilization. By collaborating with partners at the forefront of innovation, we will pursue not only synergies with our existing businesses but also opportunities to take on new businesses.

Management Goals and ROIC

In the current Medium-Term Management Plan, we have set a future ROE target of 8% or higher, while also introducing a target for performing assets ROIC necessary to achieve that level. In the 2030s, once the Ohma Nuclear Power Plant begins operation, we expect the proportion of non-performing assets to decrease. At that stage, the performing assets ROIC required to reach an ROE of 8% will be around 3.5%. As a nearer-term target, therefore, we aim to achieve a performing assets ROIC of 3.5% and an ROE of around 5% in FY2026, and have set ordinary profit of ¥90.0 billion as a management goal.

At present, each department is advancing initiatives with ROIC in mind, aiming for autonomous business operations that enable the creation of corporate value at the departmental level. At the same time, the time horizon to profitability varies by business, and growth potential cannot be fully captured simply by applying ROIC. We will therefore promote multifaceted business management that emphasizes the use of ROIC while also taking into account each department’s role, growth process, and business risks.

Changes to Shareholder Return Policy

In May 2025, we announced an update to our basic approach to shareholder returns. While maintaining ¥100 per share as the lower limit for dividends, we added share buybacks as one of the return methods to enable more flexible shareholder returns, and introduced the total payout ratio. Under this policy, we have decided on our first-ever share buy-back, with a total acquisition value of ¥20.0 billion.

Until now, we had stated a target payout ratio of around 30%. However, due to the surge in resource prices, dividends in FY2022 and FY2023 fell below this level, as profits temporarily increased from our coal mining interests in Australia. We received feedback from shareholders that this created a lack of consistency between our return policy and actual results, and lowered predictability. We recognize this as an area where management must reflect and improve. Within the Board of Directors, we held repeated discussions on balancing shareholder returns with capital structure in anticipation of a rapidly changing future—considering such factors as the transition of our business portfolio, investment plans, resource price trends, and the introduction of new measures expected in the future, such as carbon pricing. We also recognize that our shareholders have valued the fact that we have not reduced our dividend once in the 20 years since listing. Taking this into account, we judged that it would be difficult to increase dividends in today’s uncertain business environment. However, by maintaining the current dividend as a minimum and adding share buybacks as a flexible return method, we believe we have established a more predictable shareholder return policy.

Sustainability and Improving Corporate Value

Focus on Material Issues and Local Community Engagement

For the J-POWER Group to enhance corporate value and achieve sustainable growth, promoting sustainability is essential. At present, we have defined five material issues—supply of energy, response to climate change, respect for people, engagement with local communities, and enhancement of our business foundation—and are advancing initiatives toward each of these goals.

Over the past year, we have placed particular emphasis on engagement with local communities. Worldwide, in addition to the TCFD, attention is increasingly focused on the TNFD, and companies are being called upon to give consideration to and take action on the natural environment and biodiversity as they advance their businesses. For J-POWER, the clearest example is in hydroelectric power, where we must conserve river and river basin environments. Operating hydroelectric power plants that require large dams entails responsibility for the environment of entire river basins. We must therefore balance the management of the natural environment, human settlements, and energy infrastructure functions. When replacing or upgrading facilities, we are strengthening our initiatives, such as by incorporating designs that reflect coexistence with stakeholders living in river basins.

Meanwhile, local communities around our business sites are experiencing both population aging and population decline. In some areas, cultural, artistic, sports, and volunteer activities in which we have long participated are becoming difficult to sustain. In response, since April 2025 our newly established Public Relations & Community Relations Department has taken the lead in accelerating efforts to connect and coordinate local community engagement activities that had previously been carried out independently at each site. We believe that enabling employees who work at different sites across the Group to travel between regions and participate in activities not only enhances our contribution to local communities, but also strengthens ties within the Group and helps rediscover the unique strengths of each department and site.

Human Resources Strategy

Since assuming the presidency, I have visited around 70 business sites in Japan and overseas, emphasizing the importance of connecting management with frontline staff and of fostering a stance of meeting halfway to strengthen horizontal as well as vertical connections across the Group. Translating philosophy into action is never easy, but I feel that employees’ understanding of this approach has been steadily spreading. Given the diverse businesses of the J-POWER Group, each department and site faces its own unique challenges. However, if, for example, a department that has innovative ideas but lacks the facilities to realize them and a site that is seeking new ways to utilize its equipment or space can complement each other’s shortcomings, new business opportunities are bound to emerge. We can also expect broad-ranging synergies, such as applying expertise gained in our domestic operations to overseas businesses, and conversely, using experience from overseas to help solve challenges in Japan.

Underlying such exchanges among people is what I see as a common language: contributing to society through energy. When I spoke with the CEO of Genex, an Australian company we made a wholly owned subsidiary in July 2024, he told me, “Because I feel that J-POWER shares the same spirit of contributing to society through energy business development, our M∓A will succeed.” Energy is a universally needed resource, and the principle of contributing to society through business development is one that can be shared across different countries and regions. I believe that sharing the J-POWER Group’s corporate philosophy and purpose will further enhance our corporate value wherever in the world we operate.

At the same time, to attract a more diverse range of talent and enable them to perform at their best, improvements in our systems and frameworks are also necessary. By continuing to enhance human resource development and work-life balance initiatives, we will further raise employee engagement and aim to build a company where new challenges are being created.

Corporate Governance

With respect to corporate governance, we have worked to invigorate discussions at Board of Directors meetings and to strengthen the system of checks and balances, for example through opinion exchanges with Outside Directors.

In June 2025, we reduced the number of Directors by one, moving to a structure of 15 members consisting of nine Internal Directors and six Outside Directors. Given that the J-POWER Group operates across a wide range of business divisions, it is essential to have Directors with specialized knowledge and experience in areas such as electricity, civil engineering, construction, chemistry, and communications. At the same time, the efficiency of discussions at the Board of Directors is also an important consideration, and there is a need to ensure both swifter decision-making and smoother operations. With these perspectives in mind, we will continue discussions regarding the optimal form of the Board of Directors going forward.

Message to Our Stakeholders

Precisely because the outlook for the future is more difficult than ever to discern, and uncertainty in international affairs and the economic environment is mounting, we find our work all the more rewarding. What the J-POWER Group must do is steadily advance initiatives to supply electricity at low cost and with stability, with a view to a sustainable society, while generating profits and returning them to our shareholders.

Our new investments and projects will not be limited to Japan. By carefully assessing market and regulatory trends around the world, we will focus our resources on investments that offer both strong returns and high predictability. At the same time, with respect to existing sites, we will work to renew our business portfolio and business models. The J-POWER Group’s greatest strength lies in our diverse portfolio of power sources in Japan and overseas, together with our expertise in their development and operation. By deploying our resources swiftly into areas where demand is growing, we will achieve both growth and contribution to society.

To realize this, the cooperation of all our stakeholders is indispensable. We will continue to enhance opportunities for dialogue with you and strive to build trust.