Financial Indices [Consolidated]

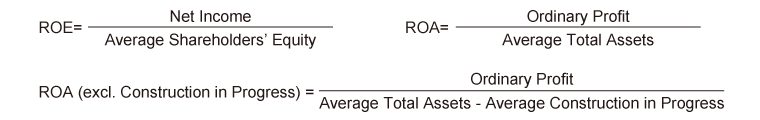

ROE/ROA/ROA (excl. Construction in Progress)

- * Net Income (Profit Attributable to owners of parent)

Per Share

- (Note)Amounts less than 1 yen have been rounded down.

Consolidated Financial Indices

|

2019/3 |

2020/3 |

2021/3 |

2022/3 |

2023/3 |

| Return on Equity(ROE) (%) |

5.8 |

5.3 |

2.8 |

8.1 |

11.4 |

| Return on Assets(ROA) (%) |

2.5 |

2.8 |

2.2 |

2.5 |

5.3 |

| ROA(excl. Construction in Progress) (%) |

3.2 |

3.6 |

2.8 |

3.1 |

6.6 |

| Earning per Share (EPS) (Yen) |

252.68 |

230.96 |

121.85 |

380.70 |

621.50 |

| Net Assets per Share(BPS) (Yen) |

4,356.54 |

4,412.84 |

4,420.39 |

5,004.31 |

5,931.68 |

| Prince Earning Ratio(PER) (Times) |

10.7 |

9.4 |

15.9 |

4.6 |

3.4 |

| Price Book-Value Ratio(PBR) (Times) |

0.6 |

0.5 |

0.4 |

0.3 |

0.4 |

| Interest Coverage Ratio (Times)*1 |

5.7 |

6.2 |

7.3 |

6.0 |

5.9 |

| D/E Ratio (Times)*2 |

2.1 |

2.0 |

2.1 |

2.0 |

1.7 |

- *1Interest Coverage Ratio = Operating CF / Interest Paid

- *2D/E Ratio = Interest-Bearing Debt / Shareholders' Equity